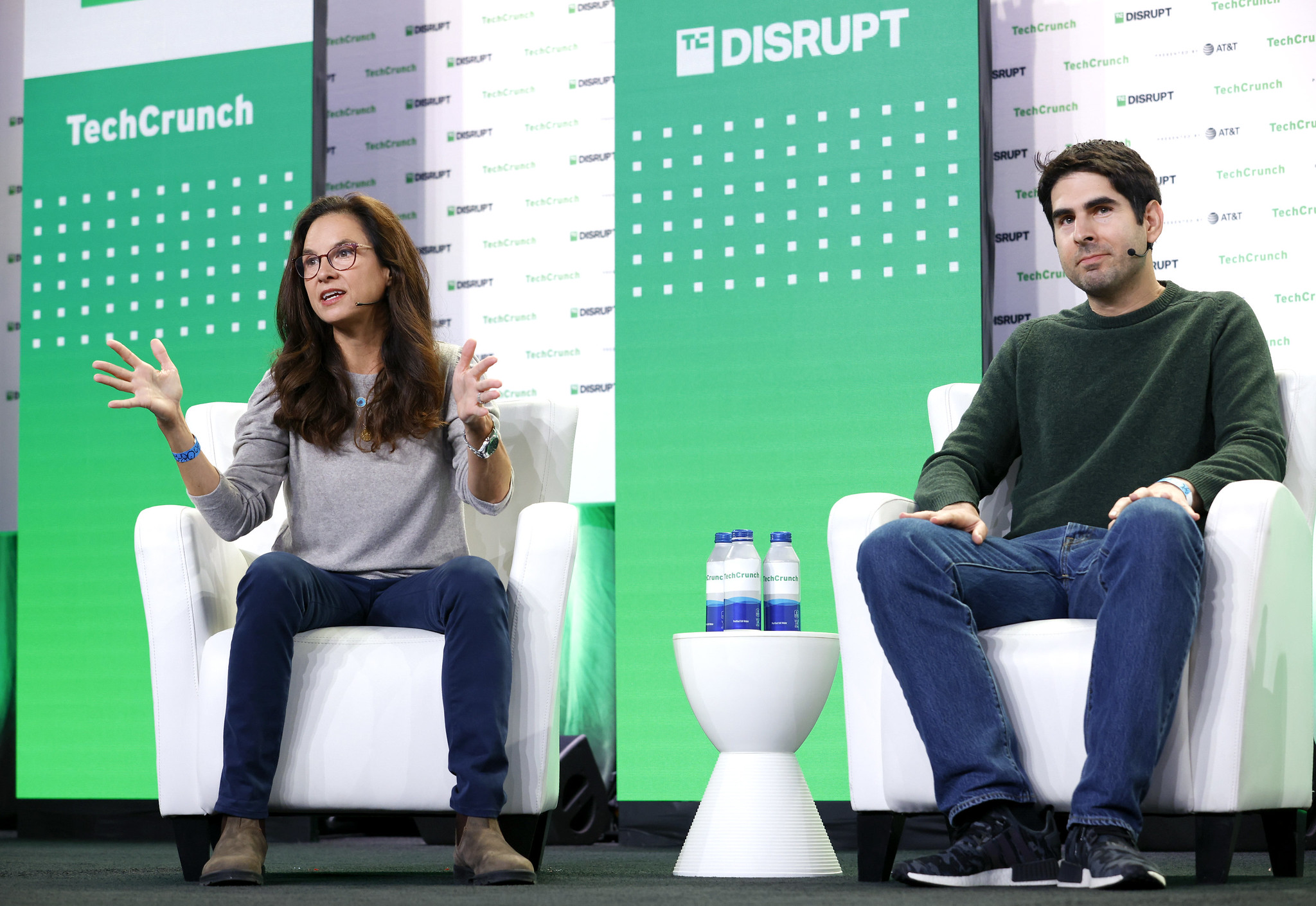

Last week at TechCrunch’s yearly Disrupt function, this editor sat down with VCs from two firms that have come to search similar in techniques about the last 5 or so many years. A single of those VCs was Niko Bonatsos, a controlling lover at Normal Catalyst (GC), a 22-calendar year-aged agency that began as an early-stage undertaking outfit in Boston and that now manages quite a few tens of billions of pounds across as a registered financial commitment advisor. Bonatsos was joined onstage by Caryn Marooney, a associate at Coatue, which started lifestyle as a hedge fund in 1999 and now also invests in expansion- and early-phase startups. (Coatue is managing even extra billions than Standard Catalyst – upwards of $90 billion, for each 1 report.)

Simply because of this blurring of what it signifies to be a undertaking company, significantly of the discuss centered on the outcome of this evolution. We puzzled: does it make great sense that companies like Coatue and GC (and Perception Associates and Andreessen Horowitz and Sequoia Capital) now deal with virtually every single stage of tech investing, or would their very own investors be better off if they’d remained additional specialised?

Although Bonatsos identified as his business and its rivals “products of the times,” it is easy to speculate whether or not their items are likely to continue being fairly as interesting in the coming yrs. Most problematic right now: the exit marketplace is all but frozen. It’s also challenging to deliver outsize returns when you have lifted the amounts that we’ve observed stream to enterprise firms above the previous handful of many years. Standard Catalyst, for illustration, closed on $4.6 billion back in February. Coatue in the meantime closed on $6.6 billion for its fifth growth-expenditure strategy as of April, and it is reportedly in the sector for a $500 million early-phase fund at the instant. Which is a lot of income to double or triple, not to mention increase tenfold. (Ordinarily, venture companies have aimed to 10x investors’ bucks.)

In the meantime, not a one firm — about which I’m conscious, in any case — has expressed options to give investors back again some of the massive quantities of capital it has raised.

I was contemplating now about past week’s discussion and have some extra ideas about what we discussed on phase (in italics). What follows are excerpts from the job interview. To capture the whole dialogue, you can observe it all over the 1:13-minute mark in the video below.

TC: For yrs, we have viewed a blurring of what a “venture” organization actually means. What is the consequence when absolutely everyone is executing anything?

NB: Not all people has attained the ideal to do everything. We’re conversing about 10 to maybe 12 firms that [are now] capable of accomplishing every little thing. In our circumstance, we begun from remaining an early-stage business early phase proceeds to be our main. And we discovered from serving our clients – the founders – that they want to make enduring companies and they want to continue to be non-public for extended. And as a final result, we felt like elevating expansion cash was a thing that could meet up with their calls for and we did that. And around time, we made a decision to develop into a registered investment advisor as nicely, since it created perception [as portfolio companies] went community and [would] mature really nicely in the public market and we could keep on to be with them [on their] journey for a more time time period of time rather of exiting early on as we were being carrying out in former times.

CM: I come to feel like we’re now in this put of rather intriguing modify . . .We’re all shifting to meet up with the demands of the founders and the LPS who have confidence in us with their income [and for whom] we need to be more artistic. We all go to in which the desires are and the ecosystem is. I think the issue that stayed the very same is perhaps the VC vest. The Patagonia vest has been pretty common but every thing else is altering.

Marooney was joking of study course. It ought to also be mentioned that the Patagonia vest has fallen out of style, replaced by an even far more costly vest! But she and Bonatsos had been suitable about meeting the demands of their buyers. To a big diploma, their companies have simply said certainly to the revenue that’s been handed to them to invest. Stanford Administration Business CEO Robert Wallace told The Info just last 7 days that if it could, the university would things even far more money into specific venture coffers as it seeks our exceptional returns. Stanford has its individual scaling problem, stated Wallace: “As our endowment gets greater, the quantity of capability that we receive from these really diligently managed, incredibly disciplined early-phase resources doesn’t go up proportionally . . .We can get more than we obtained 15 or 20 yrs in the past, but it is not sufficient.”

TC: LPs had history returns final calendar year. But this 12 months, their returns are abysmal and I do marvel if it owes in some element to the overlapping stakes they individual in the similar businesses as you are all converging on the similar [founding teams]. Ought to LPs be worried that you are now operating in every single other’s lanes?

NB: I personally really don’t see how this is different than how it used to be. If you’re an LP at a top endowment right now, you want to have a piece of the major 20 tech organizations that get started every 12 months that could turn out to be the Upcoming Major Matter. [The difference is that] now, the results in far more the latest decades have been substantially more substantial than at any time before. . . . What LPs have to do, as has been the scenario around the very last 10 years, is to commit in different pools of capital that the VC corporations give them allocation to. Traditionally, that was in early-phase cash now you have selections to commit in several distinctive automobiles.

In true time, I moved on to the next dilemma, asking whether or not we’d see a “right sizing” of the field as returns shrink and exit paths mature chilly. Bonatsos answered that VC remains a “very dynamic ecosystem” that, “like other species, will have to go by means of the natural collection cycle. It’s going to be the survival of the fittest.” But it in all probability produced perception to linger longer on the concern of overlapping investments simply because I’m not confident I concur that the market is functioning the exact same way it has. It is real that the exits are larger, but there is small question that numerous privately held businesses raised far too a great deal money at valuations that the general public industry was never heading to help mainly because so many companies with much also a great deal income were chasing them.

TC: In the planet of startups, electricity shifts from founders to VCs and back once more, but until eventually really lately, it had developed founder friendly to an astonishing degree. I’m thinking of Hopin, a digital activities organization that was launched in 2019. According to the Money Times, the founder was in a position to dollars out almost $200 million well worth of shares and nevertheless owns 40% of the firm, which I obtain brain-blowing. What occurred?

NB. Properly, we ended up just one of the traders in Hopin.

TC: Equally of your corporations had been.

NB: For a period of time, it was the swiftest-increasing company of all time. It is a really successful business enterprise. Also COVID transpired and they had the ideal products at the best time for the whole entire world. Again then Zoom was undertaking seriously, actually nicely as a company. And it was the starting of the ridiculous VC funding acceleration interval that will get started in the 2nd 50 percent of 2020. So a great deal of us received intrigued for the reason that the product or service appeared perfect. The marketplace opportunity seemed quite sizable, and the organization was not consuming any dollars. And when you have a quite aggressive market condition where you have a founder who receives like 10 various provides, some provides want to sweeten the deal a tiny bit to make it a lot more convincing.

TC: Absolutely nothing versus founders, but the men and women who have because been laid off from Hopin must have been seething, examining [these details]. Have been any lessons acquired, or will the exact same matter occur once more due to the fact that is just the way items get the job done?

CM: I think that persons who start off providers now are no longer beneath that like [misperception that] every thing goes up into the appropriate. I think the generation of individuals that commence now on each sides are heading to be significantly a lot more obvious-eyed. I also assume there was this sense of like, “Oh, I just want cash with no strings attached.” . . . And that has considerably altered [to], “Have you noticed any of this ahead of simply because I could use some assistance.”

NB: Certainly. Marketplace conditions have improved. If you’re raising a advancement round currently and you’re not one of 1 [type of company] or exceeding your prepare radically, it’s possibly tougher since a ton of the crossover cash or late-phase investors go open up their Charles Schwab brokerage account and they can see what the phrases are there and they’re much better. And they can obtain nowadays they can market following week. With a personal company, you just can’t do that. At the incredibly early stage, it’s a small little bit of a function of how numerous funds are out there that are keen to publish checks and how a great deal cash they’ve raised, so at the seed phase, we have not seen much of a difference yet, in particular for initially checks. If you’re a seed corporation that raised past year or the calendar year just before, and you haven’t designed plenty of progress to generate the proper to elevate a Sequence A, it is a small bit more difficult. . .To the finest of my information, I haven’t noticed firms come to a decision to raise a Series A with truly awful phrases. But of study course we’ve seen this process take more time than in advance of we’ve witnessed some firms make a decision to raise a bridge round [in the hopes of getting to that A round eventually].

For what it’s well worth, I suspect early founder liquidity is a significantly even larger and thornier problem than VCs want to permit on. In actuality, I talked afterwards at Disrupt with an trader who claimed that he has found a number of founders in social configurations whose businesses have been floundering but mainly because they have been able to wander away with millions of dollars at the outset, they are not precisely killing them selves striving to preserve individuals organizations.

TC: The exit current market is cooked appropriate now. SPACs are out. Only 14 firms have selected a immediate listing considering the fact that [Spotify used one] in 2018. What are we likely to do with all these several, several, many corporations that have nowhere to go proper now?

NB: We’re really lucky, particularly in San Francisco, that there are so a lot of tech companies that are doing really, really well. They have a great deal of funds on their balance sheet and ideally at some point, especially now that valuations look to be much more rationalized, they will need to innovate as a result of some M&A. In our industry, particularly for the massive corporations like ours, we want to see some more compact exits, but it’s about the enduring companies that seriously can go the distance and produce a 100x return and pay for the full classic or the entire portfolio. So it’s an interesting time, what’s heading on appropriate now in the exit landscape. With the conditions rationalizing, I would assume we’ll see much more M&A.

The natural way, there will never be adequate acquisitions to preserve most of the corporations that have been given funding in modern decades, but to Bonatsos’s position, VCs are betting that some of these exits will be massive plenty of to retain institutional buyers as eager on VC as they’ve grown. We’ll see around the upcoming couple of many years if this gamble performs out the way they assume.