If you informed me that a corporation that’s charging $70 per thirty day period for multivitamins would be capable to increase a $10 million round, I’d need to see the receipts, and I’d be incredibly curious in fact to see its pitch deck. It seems to be like now is my lucky day!

Rootine is the business, and the founders were being gracious sufficient to share their pitch deck with me. Let us determine out what the investors observed in this startup.

The business very first turned up in TechCrunch’s protection as part of the Techstars accelerator back in 2018. Anthony Ha claimed that the organization experienced 1,500 spending consumers in Europe and was gunning for a U.S. expansion. It looks like that was a lengthy journey that in the long run labored out.

Rootine’s deck is my 30th teardown — time flies! You can see the rest of them here, in case today’s go through is not really plenty of pitch decking for you.

We’re on the lookout for far more one of a kind pitch decks to tear down, so if you want to submit your possess, here’s how you can do that.

Slides in this deck

The Rootine deck consists of 29 slides, and the crew tells me there have been no omissions or redactions — this is what the buyers noticed when they were being obtaining pitched!

- Deal with slide

- Summary slide

- Traction summary slide

- Staff slide

- “Why” slide

- Market place context slide

- Current market dimension and industry trajectory slide

- Dilemma slide

- Option slide

- “Community boosts member experience” — neighborhood slide

- Business model slide

- “The Precision Multivitamin”— solution slide

- “Supported by a wide variety of at-household lab tests”— merchandise slide

- “Innovative sort variable for diet products”— product or service slide

- Technology slide

- “Feedback loop”— products slide

- “How it works” slide — tracking member outcomes

- Customer (“member”) final results slide

- Product traction slide

- Customer traction slide

- Partnership traction slide

- Competitive landscape slide

- Vision slide

- Product road map slide

- Revenue projection slide

- Go-to-market place evolution slide

- Advisors slide

- The check with and use of money slide

- Contact details slide

Three matters to really like

Rootine’s slide deck is a masterclass it handles every little thing I would expect in a deck. It does go deeper than I would have preferred into the product, but when I seemed as a result of it again, there’s not a large amount I can clear away from this deck to make it considerably greater. Incidentally, there’s also not a whole lot I would increase. That is a fantastic indicator. Let’s test out some of the highlights.

An “ask” slide

By fairly some appreciable margin, the “ask and use of funds” slide is the most commonly screwed-up slide in pitch decks, in my practical experience. This a person is not ideal, but I’m so happy it is there, for the reason that it will help lead the conversation for what takes place subsequent.

[Slide 28] Good use of cash slide. Image Credits: Rootine

I wish the firm had integrated how much revenue it was raising on this slide to give it a sliver of extra context. But which is an apart I enjoy the clarity right here. Expanding ARR and membership quantities 3x and launching eight new solutions is a wonderful established of targets. I desire the company had integrated deadlines (indeed, 3x ARR … but when?), and “key hires” and “expand teams” are as well fluffy. But most startups really don’t include any of this, so pretty properly completed there.

Just one tiny depth, though: 30% advancement, 40% tech, 20% neighborhood, 20% ops. Oops. I appreciate the realism that all the things in startups can operate around price range, and I think in the knowledge of elevating far more than you believe you are going to need to have, but I’m rather confident most traders would want the use of funds to include up to 100%.

As a startup, the lesson listed here is to exhibit that you have clarity around why you are increasing revenue, as very well as what you’re going to accomplish with the cash. It is embarrassingly rare to see possibly of these points plainly outlined — and it is actually the complete reason of a pitch deck. Rootine’s example above is a fantastic jumping-off issue. Make it your individual make it very good.

Traction galore

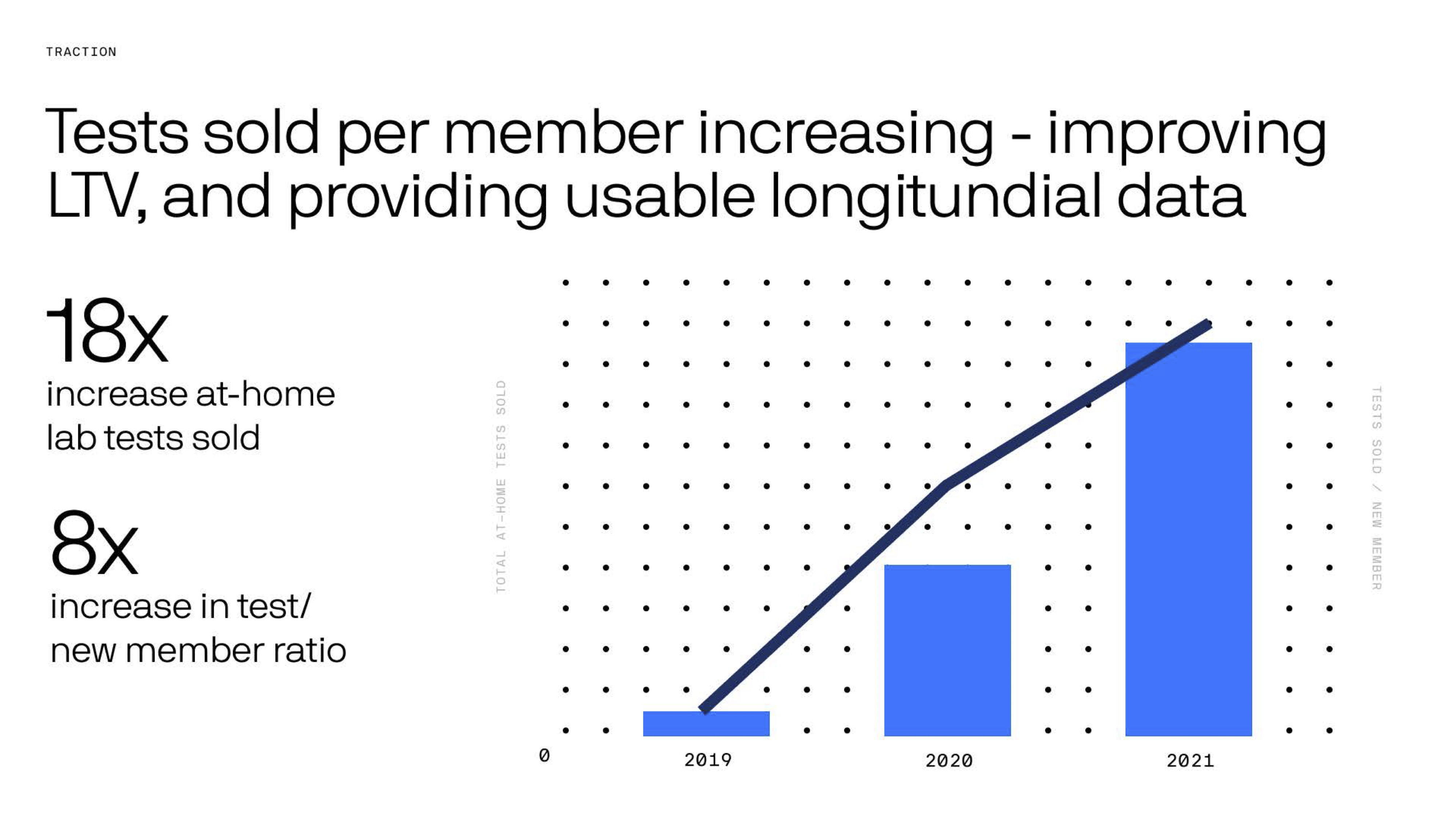

Rootine has a few traction slides in its deck (just one that will make me disappointed, but we’ll get to that 1), but I like how it flexes its numbers in different strategies to clearly show how effectively the organization is carrying out. Slide 19 showcases some actually cool traction:

[Slide 19] Holy traction, Batman. Image Credits: Rootine

An 18x increase in two yrs is objectively powerful. Not possessing numbers on the axes is a little bit of a cheat (why‽), but the development is apparent, so that is encouraging. The slide I seriously want to celebrate Rootine for, although, is the “summary” slide much previously in the deck. Slide 2:

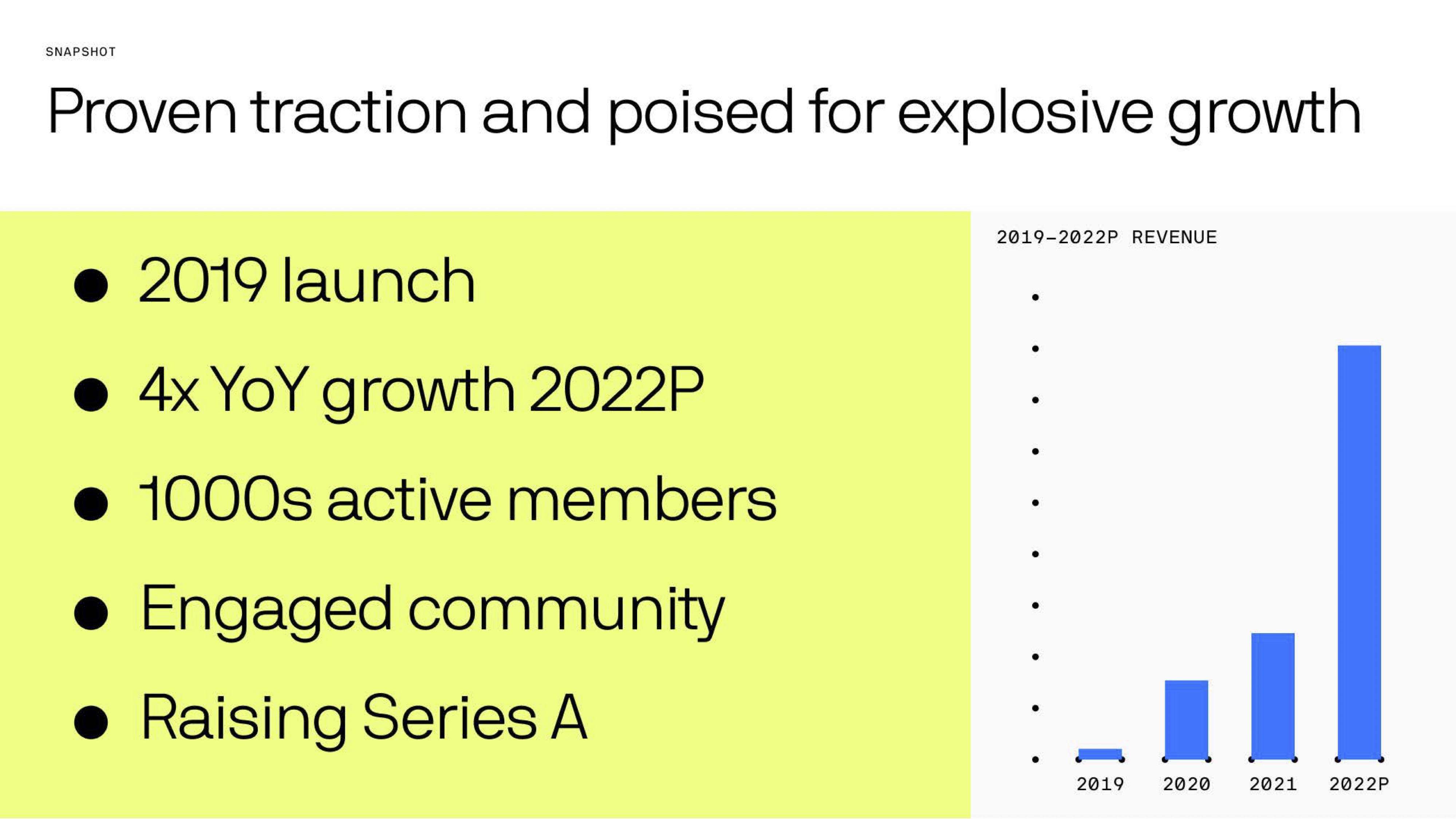

[Slide 3] Kicking off the story with a summary of the metrics. Graphic Credits: Rootine

I’m a sucker for a superior enterprise-by-the-figures-type slide. I’m a minimal confused by the inconsistencies. TechCrunch described that the business had 1,500 or so prospects back in 2018, so the 2019 “launch” appears to be odd. It is also dangerous to clearly show projected numbers as section of slides owning it in two colours (blue for “real” numbers and perhaps grey for the projected quantities) might have felt additional genuine.

I’d also have appreciated to see additional element about the quantities guiding the figures. Acquisition expenses, margins and all the quantities that drive a business forward. Especially at a Sequence A, the place a firm is explicitly location by itself up for growth, it would be excellent to have more comprehensive breakdowns of how the many crucial metrics have evolved over time.

How has the consumer acquisition expense (CAC) advanced around time? How has the preliminary invest for every shopper and assumed lifetime worth for every buyer shifted? What about the fees of items marketed (COGS), and many others.? As an investor, this is in which I would invest a whole lot of my due diligence time, so it would make perception to involve most — if not all — of that as aspect of the presentation. If you are positioning your self as becoming completely ready for development, present that the quantities assist that!

As a startup, contemplate how you can use the figures driving your corporation to notify the tale, both equally of what you have accomplished and what you are about to do. If you have significant figures that truly present the progress of your firm — use ’em to ram that place property. What you are doing is tough brag, brag, brag!

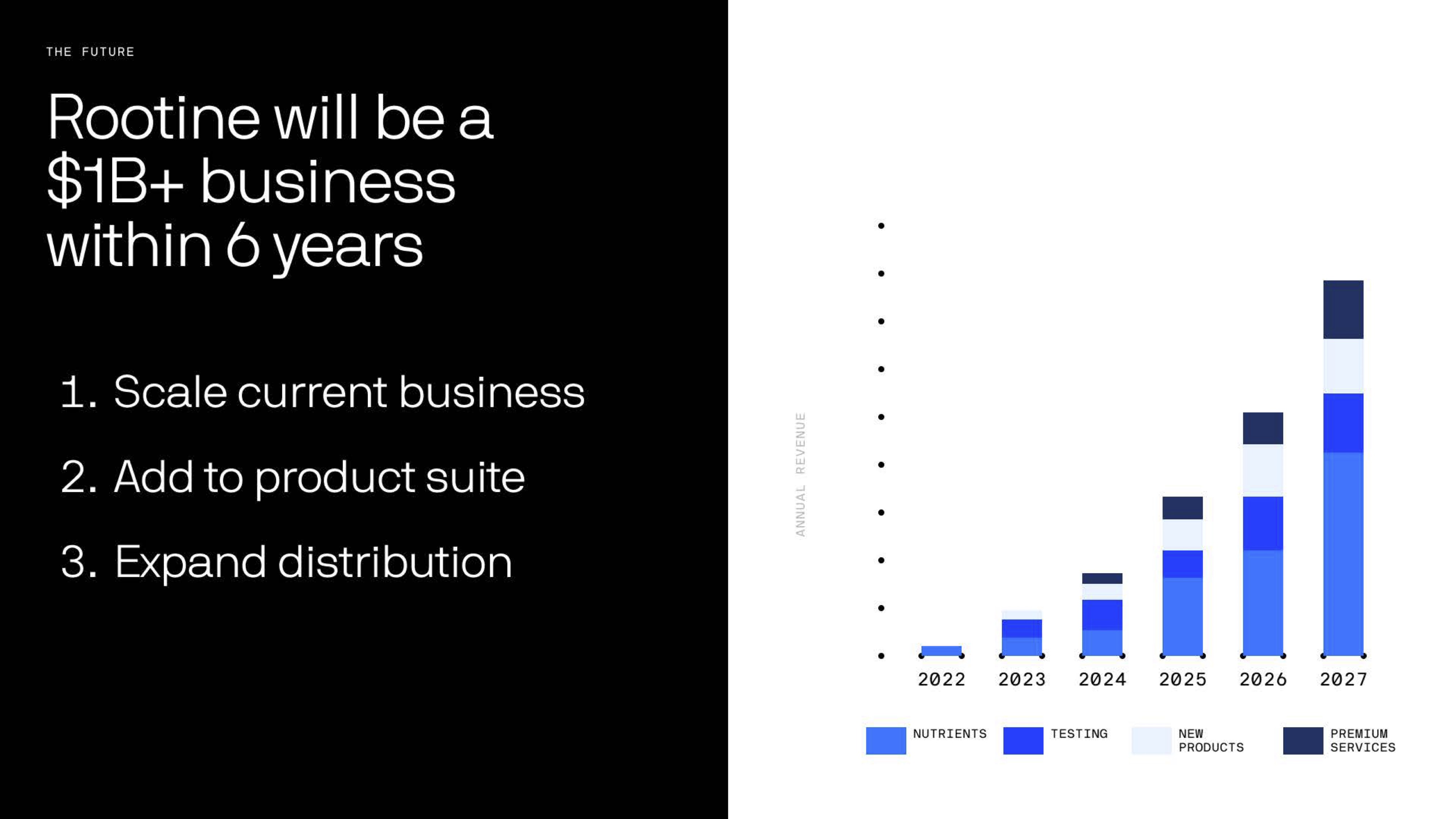

The route to $1 billion

[Slide 25] That’s a daring assert. Picture Credits: Rootine

The whole reason of a startup is to scale outrageously fast. The exponential curve Rootine is displaying in this curve seems spectacular, and I am unsurprised that the buyers acquired psyched. I also suspect investors would check with how at this level. I believe generating a assert to be a $1 billion enterprise inside of 6 decades is daring and thrilling. But you’d best exhibit up with the receipts.

I hinted at that earlier mentioned I’d want to see the figures that drive this aggressive curve. Doubts apart if you’re actively playing the VC activity and you are raising advancement capital, this is exactly the sort of declare you need to have to be equipped to make, backed with some self-assurance and the numbers to again it up.

In the relaxation of this teardown, we’ll choose a glimpse at a few things Rootine could have enhanced or performed in another way, alongside with its total pitch deck!