When Ankur Nagpal bought Teachable for a quarter of a billion pounds, he felt blessed. Then, he swiftly felt lost when making an attempt to navigate the fiscal systems of a country he wasn’t born in and study the institutional language generally only spoken fluently by the historically wealthy.

It would be a few yrs of self-employment, and making a venture agency afterwards, right before Nagpal returned to the instant as one of the early catalysts for his newest startup, Ocho. The organization, launching publicly currently, desires to make it much easier for enterprise proprietors to established up and deal with their own 401(k) retirement accounts.

Personal finance is really hard — and that’s a tale as old, and hard to disrupt, as time. And although Nagpal agrees that there is no “north star” company that has shown how to deal with finance literacy at scale, he’s hoping that Ocho’s 10-man or woman workforce may well just have a not-so-unexciting wedge that changes that.

Ocho is signing up for the several fintech firms out there that goal to modernize, and seriously rebrand, the retirement account absent from regular suppliers like Charles Schwab or Fidelity, or costly options like attorneys and consultants.

“I’ve commenced exploring the space, and we realize everybody — like Robinhood to Coinbase — is just investing unsustainable quantities of income to receive shoppers, but are creating no dollars themselves and constantly kind of will need these substantial funding rounds just to exist,” Nagpal reported. “I’m really anticipating there to be a very tough 6, 12 or 18 months for fintech businesses especially.”

Ocho’s twist from the levels of competition, he thinks, is in its market place target. “There’s so a lot of providers targeting startup founders and their wealth — there’s virtually a new one particular launching each thirty day period or two all backed by huge-name VCs, but no one is focused on the organization proprietor that is or else doing well but is not a startup founder or a startup staff,” he reported.

Instead, Ocho is leaning into Nagpal’s track record of doing work with creators when he was developing Teachable. Teachable served creators establish revenue streams Ocho would like to enable those people exact same creators consider their earnings and make investments, harvest and scale them in a good way.

“At Teachable, we aided these people make money on the internet and now there is plenty of sites for creators, freelancers and business people to make funds on the web — but how do we assist them feel about setting up wealth?” Nagpal claimed. The extended-expression eyesight for Ocho is to offer you products and solutions, over and above solo 401(k)s, that assistance organization homeowners establish wealth.

Human Fascination is one of Ocho’s closest competition, boosting $200 million at a $1 billion valuation last year. Nagpal says that Ocho differentiates alone because it is centered extra on folks, freelancers and creators, instead of Human Interest’s focus on of tiny and medium-sized companies.

For now, Ocho is charging a flat $199 once-a-year payment to assistance men and women start out their retirement account. It can take about 10 minutes to set up, and 48 hours to get closing affirmation.

The significant obstacle for the startup is receiving the right solopreneurs to care about their retirement accounts. It appears for folks who have earnings-producing organizations, but don’t have any whole-time workforce. If you have a facet gig along with your complete-time occupation, you can develop a 401(k) just for the side hustle, but simply cannot set whole-time income into the retirement account.

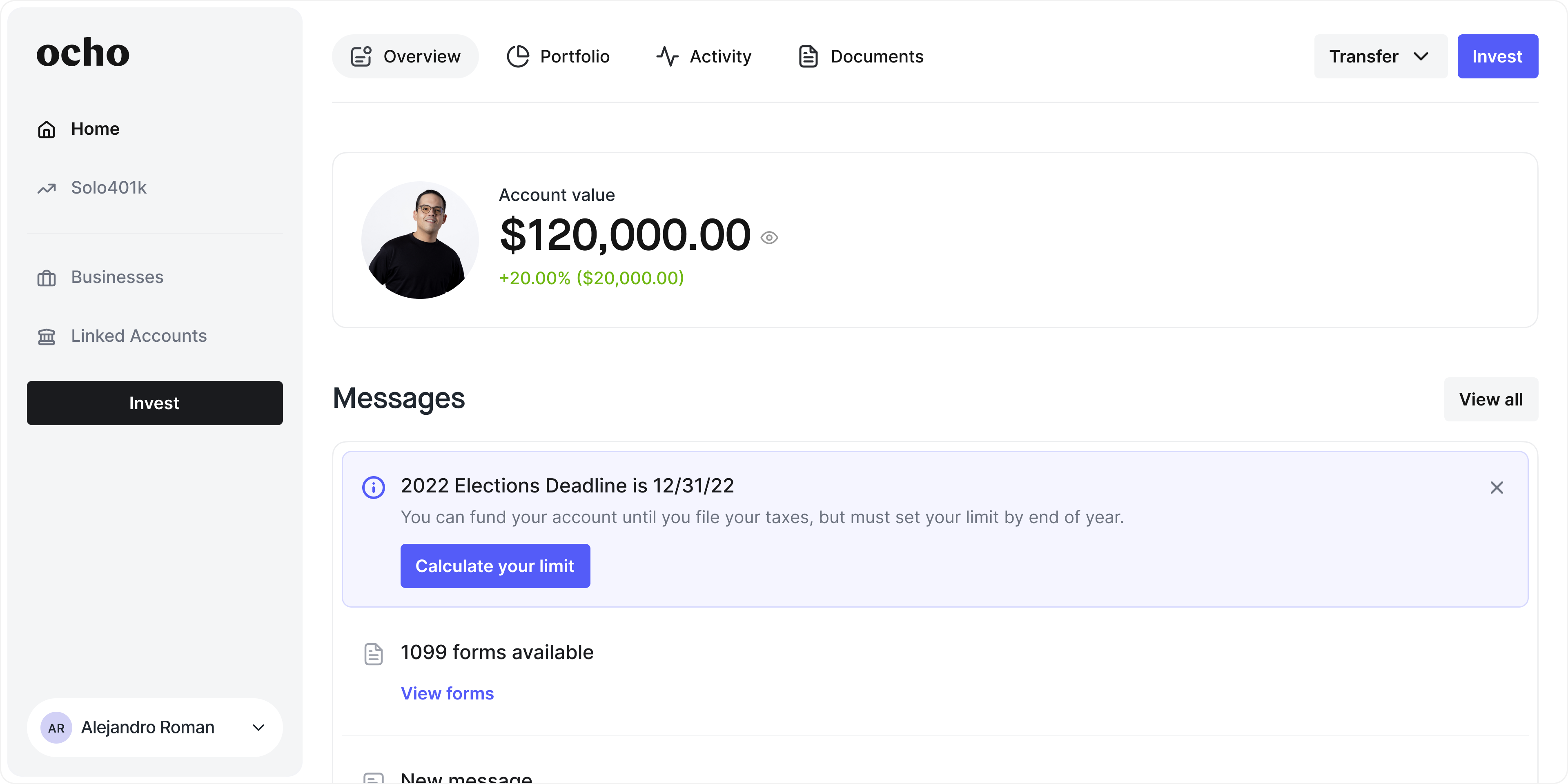

Image Credits: Ocho

Nagpal thinks he can nail early adoption by way of smart instruction materials and outreach, referring to particular finance traits on TikTok as an example of shopper demand for much more information and facts. He states that 40% of the Ocho staff members is functioning on marketing and advertising or instruction, and that the stability will be retained even as the organization scales.

If instruction is so essential to having Ocho to get the job done, one may possibly speculate why it’s launching with a fintech product or service. The response is basic: deadlines. Buyers need to make a retirement account by December 31, 2022, if they want 1 for 2023 — which puts the fintech in a applicable, but time-pressed, posture.

Nagpal isn’t apprehensive about the seasonality of the 401(k) products because of the forthcoming solution roadmap, which incorporates the instruction merchandise, investment decision flows into the retirement product or service like staying equipped to commit in startups and ETFs, and even HSAs, typically described as a 401(k) for healthcare.

To ability that formidable product spree, Ocho has lifted $2.5 million from Nagpal’s have enterprise agency, Vibe Capital. The entrepreneur suggests that he elevated the $60 million debut fund for Vibe Money with the thought that he would incubate a startup or two out of the company, which materialized currently now that it owns 20% of Ocho.

Nagpal admitted that the strategy of a founder employing his personal enterprise company to seed his possess startup may well show up to be the “mother of all conflicts of interest” but reasoned that it was anything but. He emailed all LPs in his fund about the financial commitment, acquired a unanimous of course, and finished up increasing at a substantially lower price tag for the startup than if they had gone out into the good market place. It’s nonetheless unusual to see founders market a company, commence a enterprise business and then use that exact venture company to seed their upcoming business.

Possibly the one of a kind connection in between Nagpal’s 1st company, to his business, to his newest startup, could trace at what his strategy to personal finance might be: diversify across multiple cars, redefine what a supercharged expense could glimpse like and retain on mastering.

Ocho’s starting up workforce. Graphic Credits: Ocho